A 10-bagger of a company returning 1.000% is in investing equivalent to catching Moby Dick. It is improbable it will happen; if it happens, you probably don’t have many of them. The good news is you don’t need to have many of them; one to three could be more than enough if you allocate a substantial amount of your capital to that 10-bagger.

I will in this article summarise a study and highlight the most important numbers and insights for companies returning over 1.000% from 2012 to 2022. In the end, I will give my perspective on finding 10-baggers and the conclusions from the study.

Låt oss börja med att dyka in i Jengas studie!

Först, några statistik om studien.

446 företag har gett över 1000% avkastning från 2012 till 2022.

Indien har varit det bästa presterande landet sedan början av 2000-talet.

Israel och Sverige är två avvikare när det gäller 10-baggers i förhållande till befolkningen.

Många företag underpresterade först och sedan överpresterade.

367 företag (82,3%) var lönsamma i början av studien.

79 företag (17,7%) hade ingen intäkt eller var olönsamma på EBIT i början av studien.

74% av de lönsamma företagen ökade sina intäkter snabbare än sina intäkter, vilket betonar vikten av marginaltillväxt vid sökandet efter överpresterande företag.

Det genomsnittliga lönsamma företaget sammanställde sina intäkter med 15% CAGR och sina rörelsevinster med 20% CAGR.

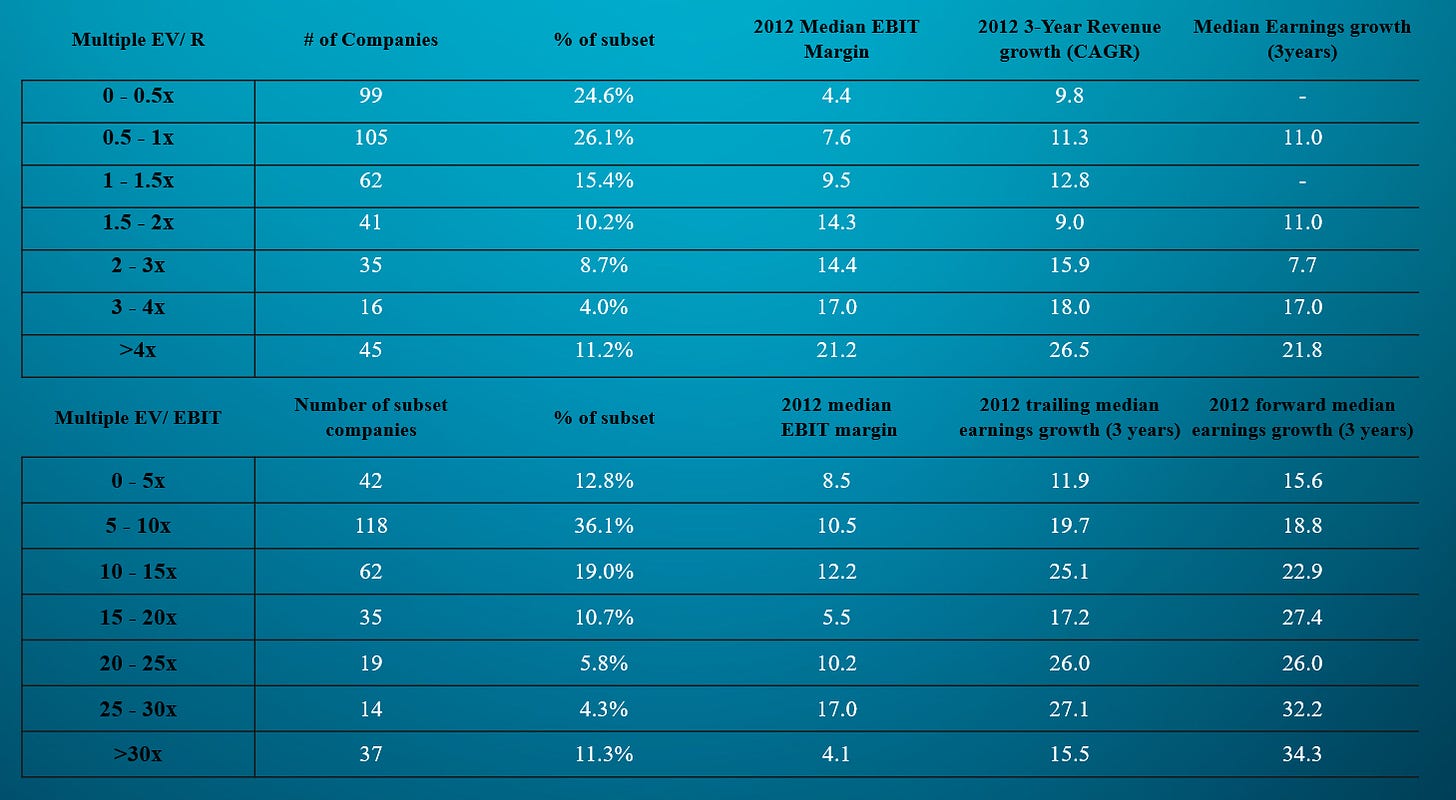

50,7% av företagen hade ett EV/Intäkter-förhållande under 1x.

67,9% av företagen hade ett EV/EBIT-förhållande under 15x.

91% av företagen såg sina EV/Intäkter-förhållanden expandera.

72% av de lönsamma företagen 2012 såg sina EV/EBIT-förhållanden expandera.

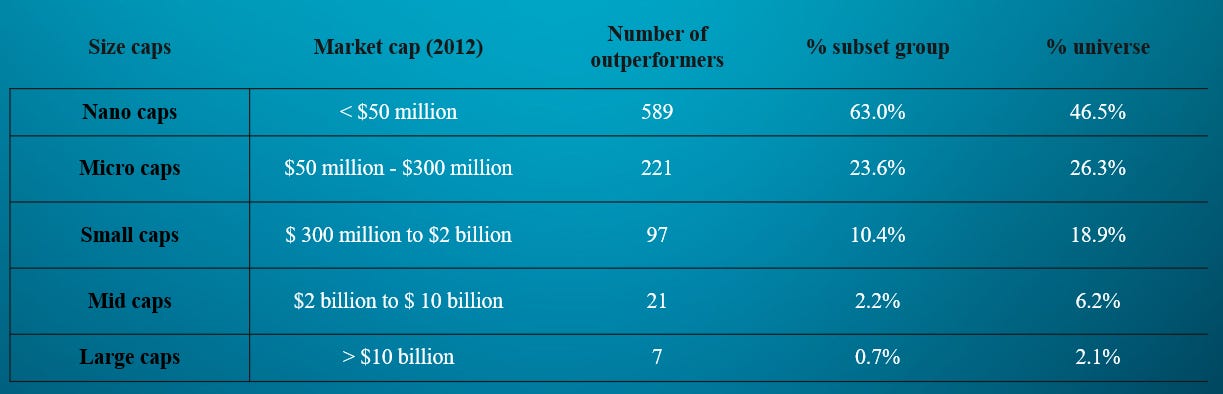

72,8% av företagen hade en börsvärde mindre än 300 miljoner dollar år 2012.

Det är viktigt att komma ihåg att "historia upprepar sig inte, men den rimmar ofta," eftersom tidigare prestation inte indikerar framtida prestation. Endast 23 av de 446 företagen hade en prestation på 1000% under de tio åren efter 2012 (mellan den 31 maj 2002 och den 31 maj 2012). Men från historien kan vi se de faktorer som driver olika överpresterande företag och försöka hitta samma egenskaper i ett nytt företag. Det ökar vår förmåga att hitta prestation och alfa på marknaden.

Jag särskilt gillar den här delen från “Global Outperformers” om investeringsstilar eller, som Peter Lynch säger, olika berättelser:

För de fallstudier du kommer att märka att var och en av de fem grundläggande investeringsstilarna var representerade (compounders, cyclicals, turnarounds, stalwarts och special situations). Vi granskade compounders som Tesla och ANTA Sports som lyckades växa sitt företag år efter år under mycket långa perioder. Vissa var cykliska möjligheter som Ganfeng Lithium och SRF Limited, där deras resultat var starkt beroende av affärscykler för deras respektive varor. Det fanns också turnaround-företag som Trex och Adobe, där ledningen hade gjort några misstag med verksamheten men hittade sätt att återställa tillväxt och marknadsledarskap.

Vissa företag som Airports of Thailand och Sony Group var långsamväxande stalwarts men genererade marknadsledande avkastning på grund av deras betydande rabatt till inre värde. Det fanns special situations som MSCI, en finansiell datagrupp som skildes från sitt moderbolag, Morgan Stanley, 2007. Det var också vanligt att företag övergår mellan olika investeringsstilar över tiden. Britannia Industries, Indiens ledande företag inom kexmarknaden, gav ett bra exempel då det gick från att vara en stalwart till en turnaround och senare blev en tillväxtcompounder.

Det är viktigt att framhäva att Jenga fokuserade på hur tillväxt, vinst, multiplar, storlek, bransch och geografisk region påverkade överprestationen för att identifiera vad som fick dessa företag att öka med över 1 000 procent.

Låt oss fortsätta och se vilka data studien kom fram till.

Först hoppar vi in på värderingar, eftersom vi kanske har haft ett decennium där värderingar inte spelade någon roll; det kan vara möjligt att börja där.

Och vi har ett resultat, damer och herrar! Värderingar spelade roll!

Företagen som startade 2012 med låga värderingar var i majoritet! Företag med en värdering lägre än 1,5x EV/R utgjorde 76,1% av delmängden, och de lönsamma företagen med en värdering lägre än 15x EV/EBIT utgjorde 67,9% av delmängden.

Samtidigt är det viktigt att påpeka att den här studien undersöker utfallet för företag som ökar med 1 000% (survivorship-biased), vilket innebär att vi kan se en ökande vinsttillväxt ju högre värderingen blir. Detta ligger i linje med den allmänna kunskapen att högre värderingar ökar förväntningarna på tillväxt och lönsamhet för ett företag. Till exempel är Amazon ett av de högst värderade företagen i delmängden.

Nu låt oss titta på lönsamhet.

Även i motsats till den inställningen som många har haft under de senaste åren är lönsamhet avgörande; av alla 446 företagen var 82% lönsamma. När vi tittar på de olönsamma företagen var det bara tre som var olönsamma under perioden; två var hälsovårdsföretag och det tredje var Plug Power. Av de olönsamma företagen utan intäkter (som inte var verksamma), kom 17 av de 21 företagen från material-, energi- och hälsovårdsindustrin. Detta är mycket logiskt eftersom utforskningen av resurser tar lång tid att etablera, och att utveckla ett läkemedel tar många år för att genomföra kliniska och prekliniska prövningar, som krävs för att få godkännande av myndigheter. De operativa företagen med tidigare lönsamhet representerades främst av två typer av företag, cykliska och företag som genomgick kriser specifika för företaget.

När vi även tittar på marginalernas utveckling så har de utvidgats avsevärt.

Företag med lönsamhet över 10% var 48%; år 2021 hade detta ökat till 85%. När vi tittar på företag med lönsamhet över 20% var det 17%, och 2021 hade detta ökat till 47%! Det visar att expansionsmarginaler kan vara en stor drivkraft för värde.

När vi tittar på tillväxten var det något överraskande att snabb tillväxt endast utgjorde 28% av de 446 företagen. Snabb tillväxt definierades som 20% CAGR under de tio åren; men 20% CAGR under 10 år är mycket svårt att uppnå.

Eftersom detta är en studie av vinnare (företag som har haft avkastning över 1 000% på tio år) och tillväxt är nödvändig för att uppnå den typen av avkastning, så har dessa företag haft det. Så de snabbväxande företagen både vad gäller intäkter och vinst har mer att säga om vilka som är de bästa bland vinnarna än att ge oss några ledtrådar för att hitta en 10-bagger. Det mest imponerande är företagen som bara uppnådde tillväxt i vinsten under dessa tio år utan intäktsökning.

Det mest imponerande numret är att det genomsnittliga lönsamma företaget sammanställde sina intäkter med 15% CAGR och sina operativa vinster med 20% CAGR. Det visar effekten av skalbarhet och ekonomier av skala.

En vanlig uppfattning inom investeringar för hög avkastning i företag är att små företag har bättre chanser att producera dessa avkastningar. Det är svårt att fördubbla 100 miljoner jämfört med 10 miljoner på grund av ren storlek. Data i Jengas studie stöder denna uppfattning, då 63% av delmängden var mindre än 50 miljoner dollar, och när storleken ökar minskar antalet företag. Det visar en tydlig korrelation mellan storlek och hög prestanda. Dock kan denna tabell också illustrera förhållandet mellan risk och belöning som korrelerar med företagens storlek. Konkurser och lågpresterande aktier är förmodligen också överrepresenterade bland Nano-caps och Microcaps.

När man tittar på de 15 främsta länderna där 10-baggers kommer ifrån är det intressant att Indien leder med rätt stor marginal. Det är också imponerande att små länder som Sverige och Israel finns med där.

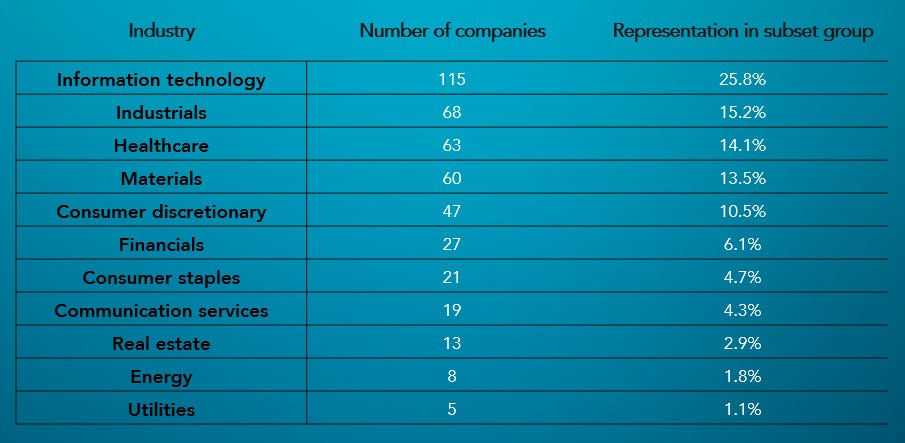

De fem främsta branscherna utgör 79,1% av företagen, där Informationsteknik presterar starkast. Informationsteknik, hälsovård och material överpresterade i förhållande till deras representation på den allmänna marknaden.

När man tittar på tabellen måste en investerare komma ihåg att den är starkt påverkad av konsumenttrender, innovation och andra strukturella trender som påverkar branscherna positivt och negativt. Till exempel, halvledare hade endast ett överpresterande företag mellan 2002-2012, medan det var 44 företag mellan 2012-2022.

För att sammanfatta ovanstående egenskaper av den hemliga receptet (eller åtminstone för att öka chanserna) för att hitta 10-baggers, är det följande:

Värdering under 1,5x EV/R och 15x EV/EBIT

Lönsam

Hög chans till marginalutvidgning

Förväntar sig vinsttillväxt

Under 300 miljoner USD i marknadsvärde

Söker efter företag i Indien, USA, Japan, Kina och Sverige

Leta efter företag inom branscher med sekulära trender

Titta på branscherna Informationsteknik, Hälsovård och Material

Det är dock viktigt att reflektera över följande stycke från studien.

With the information gathered from a key factors perspective, it may seem like a magic quantitative formula could be created to invest in outperformers, but this is far from the truth. Had we combined all our learnings across profitability, growth, multiples and size and invested in companies that had the metrics and features of most outperformers, i.e. EV/Revenue <1.5x, EV/EBIT <10x, earnings growth of 15% CAGR (assuming we could see the future), a market capitalisation of less than $300 million, we would have still missed 54% (504 of 935 companies) that later returned 1,000% over the following ten years.

Tio lärdomarna från studien:

Öppensinnighet och flexibilitet

Undvik att sätta gränser för dig själv och vara öppen för olika affärsmodeller och tillväxtprofiler. Att begränsa sig själv kan leda till att du missar potentiella 10-baggers och 100-baggers.

Framtiden är i Asien

Asien är den snabbast växande kontinenten med stora befolkningar och en växande medelklass. Detta avspeglas i ökande BNP jämfört med Europa och USA. Asiatiska aktier är också underforskade och underrepresenterade globalt, då Asien endast utgör 10% av globala fondportföljer.

Starka och svaga sidor med tematisk investering

Tematisk investering kan vara användbart för att rikta forskning mot en trend som kan prestera väl, men det är viktigt att fokusera på företagens grundläggande egenskaper. Teman kan vara ett bra screeningverktyg, men det ersätter inte noggrann due diligence och en övergripande investeringsprocess.

Värdekedja-investering

Tematisk investering och screening har sina brister, särskilt när nya branscher uppstår. Det kan vara bra att tillämpa en investeringsprocess som fokuserar på värdekedjan för att fånga de företag som revolutionerar hur vi gör saker. Att exempelvis söka efter företag med ett EV/EBIT multiplikator på mindre än 10x skulle missa Amazon.

Disciplinerad optimism

Fokusera på företagens fundamentala egenskaper oavsett det globala makrobruset. Det finns möjligheter att hitta framgångsrika företag även i ekonomiska kriser och svårigheter.

Långsiktighet och tålamod

För att hitta 10-baggers krävs en långsiktig inställning och tålamod, eftersom det tar tid för ett företag att växa exponentiellt. Många av de framgångsrika företagen hade en negativ avkastning de första två åren, men över tiden nådde de exceptionella resultat.

Cyklisk tillväxt

Många investerare undviker cykliska sektorer och går därmed miste om avkastningsmöjligheter. En betydande andel av överpresterande företag kom från cykliska industrier. Det är inte nödvändigt att tajma cykliska företag perfekt, eftersom det ofta finns gott om tid att köpa aktierna och få en hög avkastning.

Vändpunkter

Vändpunkter var också en betydande del av överpresterarna. För att en vändpunkt ska vara framgångsrik behövs identifierbara och lösliga problem, mätbara indikatorer för att bedöma framstegen samt potential för positiv förändring på grund av negativ marknadssentiment.

Kreativitet och fantasi

Båda dessa färdigheter är viktiga i investeringar för att kunna se möjligheter och investeringsfall. En idé kan leda till en annan, vilket skapar ripples-effekter. Studier av historia och liknande studier kan hjälpa till att utveckla kreativiteten inom investeringar.

Söka nya möjligheter

För att hitta nya 10-baggers behöver en investerare söka bland fler möjligheter. Att hitta ett företag som överpresterar i två årtionden är en sällsynt händelse. Endast 23 av de företag som presterade över 1000% mellan 2002 och 2012 var fortfarande bland de bästa överpresterarna mellan 2012 och 2022. Även inom de bästa överpresterarna har värderingar och ekonomiska nyckeltal ändrats över tid.

När det gäller värderingar, hade endast 12,5% av de lönsamma företagen som hade en värdering under 10x EV/EBIT fortfarande en värdering under 10x när studien avslutades. På samma sätt såg vi det med EV/R, där endast 4,7% av delmängden med en värdering under 1x fortfarande hade det vid studiens slut. Detta visar att värderingarna för många företag förändrades över tid och att det är viktigt att inte fästa sig vid en bestämd värderingsnivå utan att vara flexibel och öppen för förändringar.

Mina slutsatser

Som jag har skrivit i min artikel "De tre kriterierna för det perfekta fallet" bekräftar studien att tillväxt, marginalutvidgning och ökad värdering är viktiga faktorer för att generera avkastning.

Låt oss börja med det som jag missade i studien.

Data om emissioner av aktier och hur det påverkade investeraren i början och under investeringsperioden.

Insiders ägande från grundare, styrelseledamöter och ledning. Dock hade 67% av företagen insider-ägande över 5% jämfört med 49% av den bredare marknaden.

En kombinerad faktoranalys för att se vad som drev mest av avkastningen mellan ökad värdering, marginalutvidgning och tillväxt.

ROIC-analys för att bättre förstå kapitalallokeringen i dessa företag.

Generellt sett är resultaten inte särskilt överraskande. Det är de fundamentala faktorerna som driver avkastningen för företagen, särskilt när vi tittar på en period på 10 år.

De egenskaper som härleddes i studien kommer att öka chanserna att hitta 10-baggers. Men som Jenga nämner i rapporten skulle användningen av alla dessa faktorer vid en screening utesluta 54% av de företag som överpresterade. Därför bör en investerare förmodligen bara använda 1-3 av dessa faktorer vid användning av en screener. Även temainvestering är något jag använder för att få idéer om var jag ska söka efter nya fall, och studien bekräftar att detta är rätt tillvägagångssätt, eftersom inte alla företag inom ett tema blir vinnare. Därför kan den klusterstrategi (att köpa fem företag inom ett tema eller ett tematiskt ETF/fond) som många använder för att exponera sig för ett tema inte vara en vinnande strategi.

Det handlar om den individuella forskningen av företagen och kunskap om sektorerna. Denna studie omfattade 446 företag som presterade 1000%. En investerare skulle bara behöva 1-3 av dessa i sin portfölj för att ha enastående avkastning. Studien föreslår att en investerare bör vara öppensinnad och beredd att investera i vilken typ av investeringsfall som helst, geografiskt område, bransch och företagstyp. Jag rekommenderar en investerare som är expert inom ett visst område (förhoppningsvis på rätt plats, geografiskt eller inom branschen) över någon som försöker lära sig lite om allt.

Jag har till exempel uteslutit kinesiska företag, råvaru-/materialföretag och företag under omvändning, eftersom jag anser att risken är större där som helhet. Naturligtvis vet jag att jag kommer att missa några 10-baggers där, men det finns tillräckligt med potentiella baggers för mig att hitta ändå.

Under mina tolv år som investerare har jag hittat tre aktier som har gett över 1000% avkastning: Evolution, Vitrolife och BICO (tidigare Cellink). Men jag har missat några; några av dem nämndes i studien. Vissa köpte jag för sent för att bli en 10-bagger, och vissa sålde jag för tidigt. Exempel på företag jag missade är Vitec, Biotage, Netflix, Amazon, SalMar, Bakkafrost, Bure Equity och Cellavision.

Jag rekommenderar starkt att läsa fallstudierna!

Källa

Dokument: Global Outperformers

Författare: Dede Eyesan (←Follow him on Twitter!)

Bolag: Jenga Investment Partners

There were 589 nano cap outperformers at the start in 2012, 221 micro cap outperformers, 97 small cap outperformers and - - -. They added up to 935 in total. This is different from 446 total global outperformers mentioned in the beginning of the article.

When discussing percent of outperformers starting as nano cap and micro cap companies, the denominator used was 993. I note that Dede Eyesan also used 993 in his PDF report without specifically mentioning it. Any explanation? Thanks.