Oavsett om du är ny på din investeringsresa eller har investerat i några år, tror jag att dessa tio tips kommer att hjälpa dig att fatta bättre investeringsbeslut.

När en ny investerare börjar investera finns det ett antal saker de behöver tänka på. Denna tråd hjälper dig inte att hitta de bästa aktierna, men förhoppningsvis kan den hjälpa dig att undvika de värsta misstagen.

Varför undvika misstag?

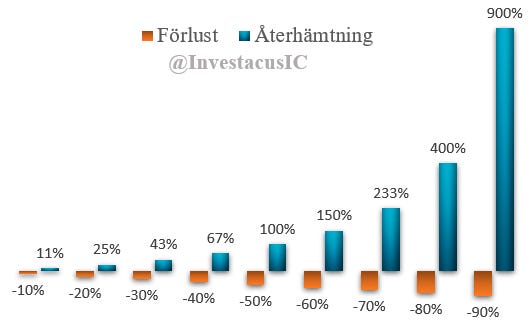

En förlust på 50% återhämtas genom en ökning på 100%. En förlust återhämtas genom en större ökning än minskningen. Så att undvika misstag är mycket viktigt eftersom det tar mer att återhämta sig. Se grafen nedan.

Det är därför Warren Buffett har två regler.

#1: Förlora inte pengar

#2: Glöm inte regel 1

Ha en långsiktig investeringshorisont eftersom aktiemarknaden fungerar med dig på lång sikt, medan den kan fungera emot dig på kort sikt. Kort sikt kommer marknaden att göra narr av dig, och du kommer bara ge dina mäklare transaktionsavgifter. De bäst presterande kontona var de konton som användaren hade glömt bort eller ägaren hade gått bort.

Fokusera på lönsamma företag som genererar kassaflöde. Om de är lönsamma och genererar kassaflöde kommer de inte att behöva ytterligare kapital för att överleva, och du kommer inte att bli utspädd eller behöva sätta in ytterligare pengar i företaget för att skydda din ägarandel.

Mathematically there is an asymmetry when investing in equities. The downside is 100%; the upside is above 100%. But the probability is more often the company goes to zero and goes bankrupt than it goes above 100%.

Följ inte stora sociala medie-konton eller investeringsbankers presentationer blint utan egen forskning. Andra forskning kan vara tidsbesparande, men det betyder inte att du inte bör göra något själv. Bekräfta forskningen och förstå investeringscasen. Ha din egen åsikt om investeringscasen; notera ner 2-3 saker du kommer att kontrollera varje kvartal och de som går emot din investeringsplan. Du kommer oftast vara sist att sälja när det inte längre stämmer överens med din ursprungliga investeringsplan.

Investera inte pengar som du inte har råd att förlora. Stora förluster i portföljen och höga kostnader inom personlig ekonomi är en kombination som inträffar oftare än du tror. Det bästa vore att låta pengarna vara investerade i portföljen på lång sikt istället för att tro att du kan ta ut dem när som helst.

Spara en summa varje månad, oavsett marknadssentimentet, oavsett om den är upp eller ner. Försök inte att tajma marknaden; det viktigaste är tiden i marknaden. Låt pengarna arbeta för dig genom att investera dem istället för att köpa och sälja aktier. Endast bankerna vinner över Peter Lynchs fond. Magellan hade en årlig genomsnittlig avkastning på X%. Trots det förlorar den genomsnittliga investeraren pengar. Varför det? Människor försökte tajma fonden, vilket ledde till att de sålde när det var nedgång och köpte när det var uppgång. Precis tvärtom vad man vill.

Håll dig borta från finansiella produkter som optioner, derivat, CFD:er och liknande. Att förstå hur dessa produkter fungerar kräver i sig självt mycket forskning. För att citera Warren

"Derivat är finansiella massförstörelsevapen".

Om du börjar investera i 20-årsåldern, satsa på aktier och lär dig så mycket som möjligt, eftersom du har gott om tid att kompensera för misstag senare när du har en högre lön och mer tid för ränta-på-ränta-effekten. Kunskap och erfarenhet är mer värdefulla. Dessutom har du inte stora ansvar. Om du börjar investera i slutet av 30-årsåldern och har ansvar som barn, partner och kanske ett hus, har du inte tid, energi eller kunskap om marknaden. Investera åtminstone över 60% i fonder/investeringsbolag. En bra blandning skulle vara 75% fonder/investeringsbolag och 25% enskilda aktier. På det sättet har du en mix som förmodligen kommer att prestera i linje med marknaden och en del där du kan lära och ha kul. Du kan öka din andel av enskilda aktier om du ser att det fungerar för dig (den kommer att växa av sig själv om du överträffar fonderna)

Använd en "barbell approach" till risk. Låg risk inom personlig ekonomi möjliggör högre risk i din portfölj. Kom ihåg att aktier är högrisktillgångar, då du kan förlora alla dina pengar om du väljer fel. Vilket jag hoppas att du undviker genom att läsa detta inlägg.

Att investera kan vara givande, men det är viktigt att komma ihåg att det inte är utan risk. Genom att ha dessa tips i åtanke kan nya investerare undvika kostsamma misstag och fatta välgrundade investeringsbeslut.

Populära artiklar

10 Attribut hos en Fantastisk Investerare

Peter Lynchs checklista för att hitta 10-dubblerare