Tre boxar att checka av för ett perfekt investeringscase

Vad du ska leta efter i en investering som kommer generera avkastning

Om vi sammanfattar var den totala avkastningen kommer ifrån i ett fall, kommer det ner till EPS-tillväxt + P/E-värdering + utdelning.

Så om vi överväger dessa tre faktorer för avkastning i ämnet nedan, vad driver dem att öka?

Ökande nettoförsäljning

Ökande marginaler

Låg värdering

De första två påverkar den tredje på ett sätt där en högre värdering tilldelas med högre tillväxt och marginaler. Sedan måste du förstås beakta många externa faktorer, men vi lämnar dem utanför diskussionen för nu.

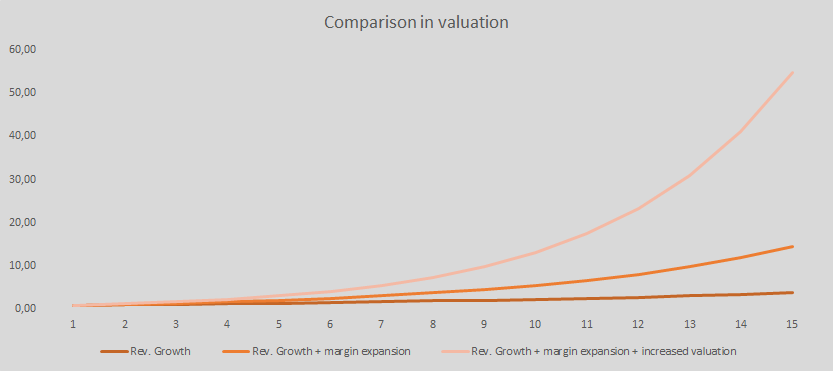

För att illustrera detta har jag gjort följande exempel med tre olika scenarier.

Scenario 1: Intäkterna ökar med 10% per år.

Scenario 2: Intäkterna ökar med 10% per år, och vinstmarginalen ökar med 10% per år.

Scenario 3: Intäkterna ökar med 10% per år, vinstmarginalen ökar med 10% per år, och värderingen ökar med 10%.

Som illustrerat är trifecta-effekten kraftfull för investerare när det gäller att generera avkastning.

I grund och botten är dessa de mått vi som investerare tittar på över tiden för att tjäna avkastning på investeringar. De två första är huvudsakligen drivna internt med vissa externa komponenter, medan den låga värderingen nästan uteslutande är en extern faktor.

Låt oss undersöka dessa tre faktorer och vad en investerare bör titta efter för att uppskatta högre nettoförsäljning och marginaler och dra slutsatsen att värderingen är låg.

Ökande intäker

Det finns många sätt att öka nettoförsäljningen, antingen genom lämpliga interna investeringar i tillgångar eller genom att förvärva tillgångar externt genom förvärv. Historiskt sett har den uppnådda tillväxten inte gett några höga värderingar. Men nyligen har tiderna förändrats (åtminstone på den svenska aktiemarknaden, och ett företag som lovar att förvärva kan få en premie för det förväntade förvärvet). Men båda dessa faktorer kokar ändå ner till avkastning på investerat kapital (ROIC) och återinvesteringsgrad. Här kan vi diskutera i vilken utsträckning utdelning är en bra sak. Signaliserar det inte att företaget har begränsade projekt att investera i för att tjäna en avkastning på kapitalet? Eller signalerar det att företaget är överkapitaliserat och att det är bättre att låta investerarna investera det någon annanstans? Så i slutändan, är ledningen bra på kapitalallokering för att tjäna en hög ROIC?

En aspekt som vi ännu inte nämnt är den marknad som företaget verkar på och har möjlighet att utvecklas inom. Är de aktiva inom ett behov som växer betydligt och ger företagets tillgångar möjlighet att utvecklas på andra marknader? Med en växande marknad och ledning som inte helt misslyckas med kapitalallokeringen kommer företaget med nästan säker sannolikhet ha högre nettoförsäljning i framtiden. Att lägga till möjligheter i deras verksamhet kommer också att ge en längre tidshorisont för ökad nettoförsäljning än vad många förväntar sig.

Ökande marginaler

Orsakerna till ökande marginaler skiljer sig åt beroende på företagets nuvarande stadium. Så anledningen kan vara flera saker. Det kan bero på att ett företag når ett punkt där deras affärsverksamhet blir skalbar, en förändring i deras affärsmodell, en förändring i produkt- och tjänstutbudet, förskjutningar i marknaden som går mot en högre marginal vid distribution av deras produkter, prisökningar utan någon förlust av kunder, minskade priser på väsentliga insatsvaror och många andra skäl som främst är interna men också kan bero på yttre orsaker.

För att gruppera det skulle jag säga att det finns två interna orsaker och en extern orsak. De två interna orsakerna kan delas in i en engångsförändring och den andra är kontinuerlig men kan vara en blandning eftersom förändringarna sker över en lång period. Jag skulle benämna den ena av kontinuerlig karaktär som "Moats" (vallgravar) och den andra skulle jag beteckna som "operationell utveckling." Jag hoppas att du ser skillnaden mellan de två.

Den externa orsaken är problematisk eftersom du behöver utvärdera om anledningen är hållbar och kommer att fortsätta eller om den kommer att vändas och ha en negativ påverkan.

Låga värderingar

Låt oss börja med att fråga: Vad är en låg värdering?

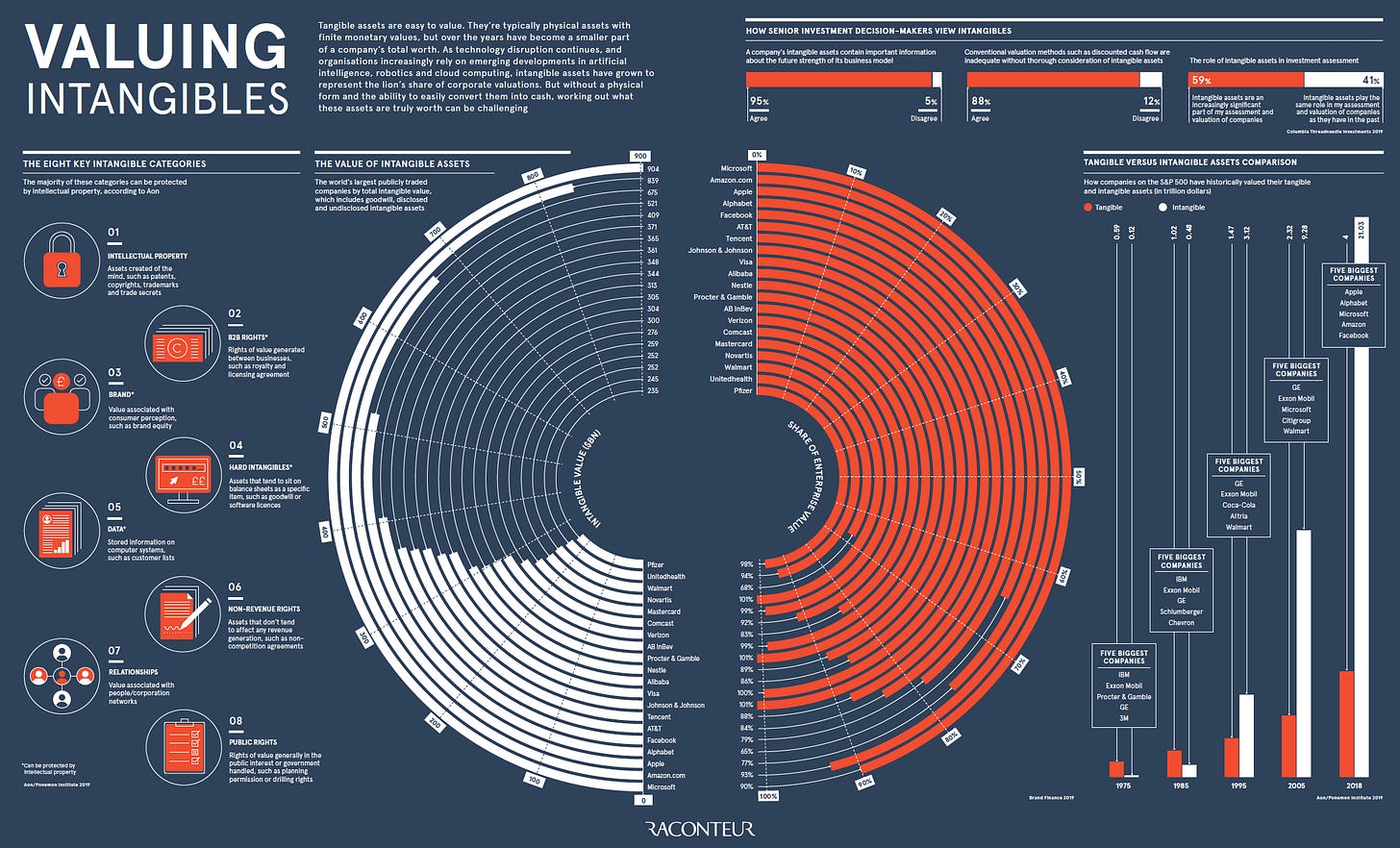

Om vi bortser från TINA-diskussionen och fokuserar på vad som har hänt de senaste åren med digitala verksamheter jämfört med traditionella analoga, ser vi att allting från produkten till distributionen och nu integrationen är digital. Det innebär att kostnaden för varor sålda (COGS) är mycket lägre, eftersom den andra skapelsen av programvaran inte medför några ytterligare kostnader, och distributionen är också gemensam eftersom logistikkostnaderna i princip är noll för mjukvara.

På sätt och vis kan man hävda att COGS har flyttats till forskning och utveckling samt avskrivningar av internt utvecklade tillgångar. Det är en produkt som säljs till kunder men inte förbrukas som en fysisk produkt. Så tjänsten kommer att användas om och om igen. Detta visas väldigt tydligt i Visual Capitalist inlägg, vilket jag rekommenderar att läsa.

Detta lämnar OPEX-kostnaderna för administration, marknadsföring, försäljning och andra driftskostnader. Dessa skiljer sig inte så mycket mellan branscher; alla behöver en marknadsavdelning, finansavdelning, försäljning och allmänna kostnader. Man kan till och med argumentera för att det finns ett behov av färre finansavdelningar och allmänna kostnader när det inte finns några fabriker som producerar något.

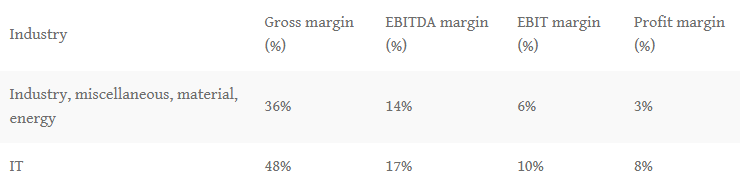

Nedan kan vi se en skillnad mellan den traditionella sektorn och IT-sektorn när det gäller genomsnittliga marginaler. Detta säger en hel del, eftersom IT-sektorn är yngre och mindre mogen, vilket i sin tur skulle innebära lägre marginaler.

Källa: Börsdata

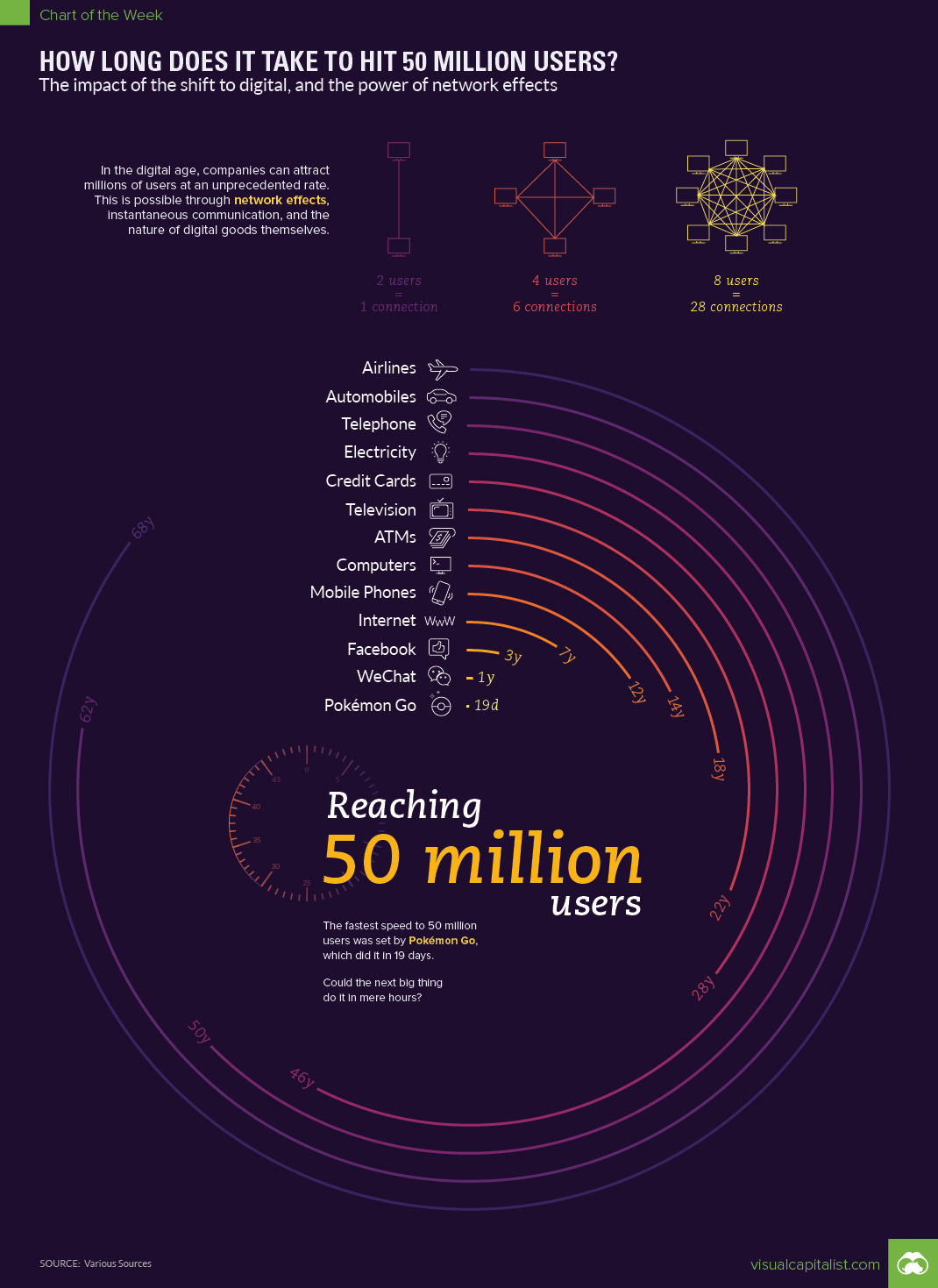

Låt oss också titta på tillväxtsidan. Att nå 50 miljoner användare har aldrig gått snabbare, och det går ännu snabbare nu. Ännu en utmärkt visualisering från Visual Capitalist.

Om vi överväger detta, skulle inte digitala företag fokusera på att växa sin användarbas och inte vara lönsamma under några år?

Särskilt eftersom konkurrensen kan växa lika snabbt, är det enda alternativet att växa så snabbt som möjligt för att etablera en användarbas som de kan göra lönsam senare. Med tanke på de höga bruttomarginalerna för digitala företag kan det också antas att vinstmarginalerna kommer att vara ganska höga.

Dessutom, med tanke på att de flesta digitala företag bygger starka nätverkseffekter och byter kostnader, kan det antas att de flesta användare kommer att stanna under lång tid. När programvara går från lokal installation till molnet på ett SaaS-modell kommer intäkterna att vara återkommande och enkelt hanteras på distans för att uppdatera kundbasen.

På grund av detta, skulle inte en hög P/S-värdering vara giltig?

Det kan låta lite som argumenten på 90-talet, men jämfört med de företagen har åtminstone dagens företag intäkter och värderas inte bara på antalet användare.

Detta argument för höga värderingar är inte så högt trots allt när detta är ett inlägg för att hitta de tre faktorer som kontrollerar för ett perfekt fall där låg värdering är en av dessa faktorer. Men jag vill hävda att du skulle missa många möjligheter om du bara tittar på en P/E-värdering och säger att den är hög, med tanke på de nya möjligheter digitala produkter och tjänster ger företag en oöverträffad skalbarhet och möjlighet att nå fler kunder än någonsin tidigare.

Men låt oss prata om låga värderingar istället för höga. En låg värdering kan bero på att det är ett okänt företag, ett affärsföretag som investerare undviker, brist på förtroende för ledningen, en ogynnsam marknadsutsikt och många andra skäl. De låga värderingarna kopplar tillbaka till de två andra kryssrutorna; du måste ha en annan syn än konsensus för att se något positivt i värderingen. Om orsaken inte ansluter till de två tidigare faktorerna kan marknaden undvika sektorn, som gamingföretag med låga värderingar eller företag under en viss marknadsvärdering. Du kan ha en fördel genom att inte behöva följa ESG-restriktioner eller andra skäl för att de bredare institutionerna inte investerar i tillgången.

Ett annat sätt att hitta låga värderingar är att titta på företag som rapporterar sina finansiella resultat enligt GAAP i ett specifikt land jämfört med IFRS. Speciellt i Sverige finns det en skillnad i hantering av avskrivningar på immateriella tillgångar; i förvärv genomför aktiva företag detta för att skapa visuellt låga intäkter; samtidigt är kassaflödet avgörande. Jag har tagit upp detta fall i två företag i min tidigare podcast "Game of Stocks", Awardit och Embracer Group, hur dessa företags värderingar såg chockande höga men låga ut. Allt på grund av redovisningsskillnader mellan svenska GAAP och IFRS, vilket gör att avskrivningen blir mycket högre än jämförelseföretagen.

Värdering skiljer sig från de andra två variablerna eftersom den återspeglar förväntningarna på omsättningsökning och marginaler. På grund av det kan du arbeta både från värderingen till förväntad omsättning och marginal, eller från förutsagd omsättning och marginal till den ansedda motiverade värderingen. Samma princip används med DCF-modeller (diskonterade kassaflöden), där du gör en konventionell DCF för att hitta det intrinsiska värdet av tillgången och en omvänd DCF för att se förväntat inneboende värde.

Om det finns något att lägga till skulle det vara en hög ROIC (avkastning på investerat kapital), eftersom det skulle kombinera höga marginaler med kapitaleffektivitet. Man kan hävda att en hög långsiktig ROIC redan tas om hand av omsättningsökning och höga marginaler, men den lägger till en variabel för kapitaleffektivitet som de tre andra kryssrutorna inte hanterar. Men detta kommer endast indirekt stödja ett perfekt fall och är viktiga för ett fall på lång sikt.

Många av er skulle hävda att det finns fler områden att överväga i ett perfekt fall, och jag håller med, särskilt på den kvalitativa sidan. Jag ville sammanfatta så mycket som möjligt, och jag kommer att hävda att allt annat spelar roll för ett fall, både kvalitativt och kvantitativt. Det rinner ner till antingen en, två eller alla tre av de ovan nämnda kryssrutorna.